When Is the Right Time to Buy a Home?

As a real estate professional, younger friends and acquaintances often ask me for advice on home buying. When is the right time to buy? Am I making a good investment at today’s prices? Etc.

This might sound strange, but I believe buying a home is not an investment. I always tell prospective homeowners to think carefully about this major commitment.

At Alliance, we invest for financial returns. Leased assets, like the single-tenant net lease properties in which we specialize, are investments that we value by expected monthly cash flows and capital appreciation. A home, however, is about personal preferences. Is it the right size? Is it in a nice neighborhood with good schools? Does it match my aesthetic tastes? Is this a place I want to stay in for years to come? Buying a home is not about generating income. It’s about having a stable place to lay our heads at night.

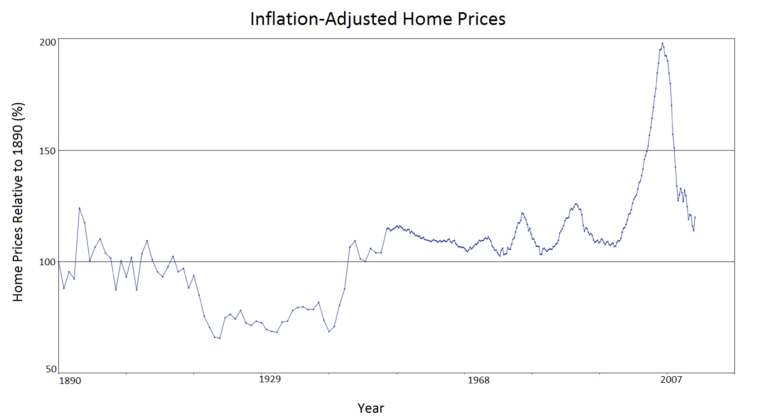

Even after prices fell, the recent housing bubble left many people with the impression that home prices rise and we should expect to get a return when selling. But if we look at the numbers, home prices seem to be quite stable, when adjusted for inflation.

The chart above reflects more than 100 years of home price data, collected by Nobel Prize winning economist Robert Shiller. It shows that inflation-adjusted home prices have risen only modestly over the past century and post-2008-bubble prices are a little above the long term average.

Before rushing to buy, also remember that closing costs make transactions expensive, so you don’t want to buy and sell frequently. Owners face perpetual property taxes and maintenance that always seems more frequent and expensive than expected. Even if your home’s value does rise, your taxes will rise too (in most states), and you’ll still need a place to live if you sell. The higher price of a replacement home can offset your gains. Meanwhile, cash put into a down payment could instead go into other investments with better expected returns.

After all these warnings about home buying, I must say that I fully endorse home ownership. Buying a home makes great sense for adults who want to settle and put down roots in a community. Owning creates a sense of permanence, stability, and comfort that is ideal for raising a family. It also comes with clear financial advantages. Your monthly mortgage payments accrue to you in the form of equity, and mortgage interest is tax deductible.

If you are ready to settle down and commit to home ownership, then I applaud you. Strong communities are built around home owners. To do it wisely, first remember that your financing really matters. Shop around for good mortgage deals and always read the fine print. I’m often shocked by how little people understand the terms of these major financial commitments. Above all, avoid over leveraging. Putting in a significant down payment will help get you better loan terms and helps ensure you can really afford what you are buying.

Evaluate a home purchase from the perspective of the quality of life returns you expect. Have you found the home you want? Do the size, location, condition, and aesthetics of the property appeal to you? Does it feel like a home you’d want to stay in for years? Is the price competitive, relative to other available options?

The choice to buy or rent should start with how you value stability vs flexibility. Every local market is different, so explore all your options. If you plan to stay for a long time and have stable income, buying might be right for you. Interest rates are still low by historical standards, so if you want to buy, it’s a good time to finance your purchase. Just don’t make the mistake of thinking that your home is a financial investment. It’s much more an investment in family and community.

Call me at 847-317-0077, email me at [email protected], or tweet me at @benreinberg or @alliancecgc if you can submit us a property to acquire and/or would like to invest with us. For further information on investing with Alliance, please click here.

My Best,